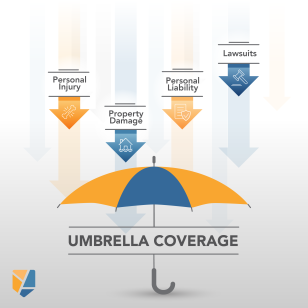

Taking an umbrella in case it rains is an excellent way to manage the risk of getting wet. Umbrellas provide coverage from uncomfortable elements. It’s an appropriate term for this specific type of insurance as well as it is often seen as a ‘just-in-case additional policy’ for your established coverage. Umbrella Insurance can potentially help in one of two ways: when your current policy limits are met*, and when you encounter circumstances that aren’t covered in the initial policy. Let’s break down what risks Umbrella Insurance can help individuals and businesses from.

Personal Umbrella Insurance

Personal umbrella insurance can cover you in a variety of ways. One example is personal injury. This type of coverage can help you in case of injury to another person in your home, outside on your property, in an auto collision, injury due to the actions of your pet, and more. This can also apply to rental properties for renters.

Commercial Umbrella Insurance

Umbrella insurance is also beneficial for business owners and companies. If your employees frequently drive for work, it can prove fruitful to invest in umbrella insurance.. Commercial Umbrella coverage can also help with property damage to your business when you are at fault.

Landlords are another industry at risk of personal injury suits due to the amount of traffic on the property. If a tenant or visitor trips on the sidewalk and want to sue, umbrella insurance can help cut down costs incured by you individually and keep you out of litigation.

Umbrella insurance is beneficial for businesses because they have a lot to lose. If you find your business at fault in a suit, umbrella insurance can help protect your financial savings and assets from being compromised after your initial policies have capped*. However, umbrella liability policies do not cover business losses, damages resulting from illegal actions, and contract disputes.

In the event your business is sued, umbrella insurance can help cover expensive courtroom costs.* This includes lawsuits unrelated to injury or damage such as slander and libel, false arrest, detention, imprisonment, malicious prosecution, and shock or mental anguish.

Sometimes life warrants a little extra coverage from the risky elements. Talk with our expert agents to determine if umbrella insurance is a valuable asset to your personal or commercial policy library.

*subject to policy terms, conditions, and exclusions